For nearly a decade, the on-trade has educated itself and customers in the spirits, pushing sales of premium products, mixed drinks and high-end cocktails – all with high margins – to the forefront of conversation. Such work has seen the category’s sales rise by 5.2% over the last year, accounting for 27.2% of on-trade value sales - or £7.2bn - according to CGA data for the 12 months to 22 February 2020.

With such high sales prior to the coronavirus lockdown, overlooking the category in your reopening plans could prove a misstep. However, operators could be forgiven for thinking customers may be tightening their purse strings or likely to be in search of a more simplified offer when they return to pubs and bars. To a certain extent this could be true, yet you only have to look at what consumers have been doing in their homes to see how important premium spirits, mixed drinks and cocktails remain.

“I think premiumisation is here to stay, particularly as everyone may have been in lockdown with only a bottle of mainstream alcohol from the supermarket or whatever they’ve been able to get their hands,” believes Richard Powell, owner of several Kuckoo cocktail bars in the north of England, says.

“When customers come back to the bar, I think they’ll be looking for us to excite them. They’ll want to taste things that blow their minds. Maybe they’ve been making cocktails at home, but now they’re going to want to taste the real thing.

“I would also expect them to be interested in products they won’t find in the supermarket and to want to talk to bartenders about the drinks. I think it’s a really exciting time to come after lockdown and that’s one area that I’m excited about – bored customers looking for excitement.”

Ranging according to Diageo:

Our recommendation is to inspire consumer confidence through best-selling brands, ensuring that the recommended range covers flavour profiles, trade up options, and those all-important treat options.

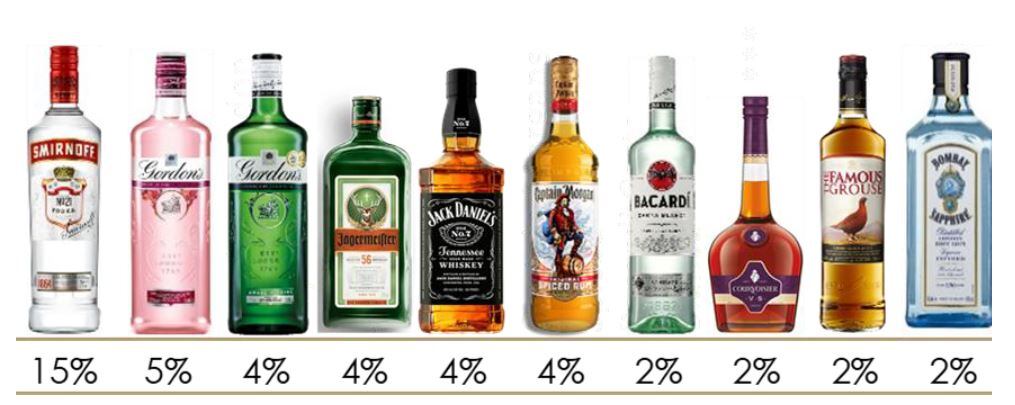

We are recommending a reduced range focused on the products and trusted brands making up the largest percentage of sales within the spirits category.

For instance, did you know that the top 10 spirits in the on-trade account for 43% of all sales?

Source: CGA to WE 28 Dec 19

A reduced range does not necessarily mean reduced choice, and it can actually deliver on several drivers for both operators and consumers:

- Simplifying the range without reducing choice means less time is spent deciding at the bar/table.

- Reduced range will ease cashflow requirement for operators reopening.

- It recognises where flavour profiles are important differentiators; and offers trade up in key categories.

- It is supported by a concise menu strategy to help support ease of choice and execution.

Diageo GB’s category advice recommends that reducing the average number of spirits stocked from 39 to 21 can still meet your customers’ requirements.

Powell also believes that pubs and bars may have to hang their business’s strategies, for the immediate future anyway, on the premium end of the market. He explains that social distancing is going to cut the number of customers allowed in a site and therefore operators won’t be able to cash in on high footfall.

Instead, he continues, pubs and bars will have to work out how to spread trade more evenly throughout the week and ensure that every customer is spending as much as possible. “It’s 100% about making the experience super-premium, we’ll need to make the most sales from the fewest people,” he adds.

“We have our midweek spend per-head targets, which we achieve. But they drop dramatically when it comes to the weekend because we’re dealing with higher footfall. We’re going to have to learn how to spread customers out better across the whole week.”

Overall, Powell is upbeat about the immediate future of the on-trade, believing many customers will jump at coming back to the trade – abiding by social distancing rules, of course. He also believes customers will want something similar to what they had prior to lockdown. The stats are there to back Powell, so much so that global spirits supplier Diageo also remains confident the trends customers were buying into before lockdown will remain, with Dayalan Nayager, the company’s managing director for Great Britain, Ireland and France, adding he remains confident that once the current public health crisis passes, “our consumers and your customers will return to bars, pubs and restaurants”.

The figures providing such positivity are based around long-term trends within the spirits category, which showed sustained growth over the last five years. For instance, between 2015 and 2019, according to alcohol trends tracker IWSR, the value of spirits grew by 14.4%, with volumes up 5.2%. It adds that the uptick has been driven by consumers increasingly choosing premium spirits.

In brief, the main trends were:

- Growth of premium sales – Across all sub-categories, with a particular focus on gin, vodka, whisky and tequila, pre-coronavirus premium spirits represented 26.2% of all on-trade spirits sales, growing at 7.4% compared with the previous year (CGA OPME MAT 22.02.20)

- Cocktails – The cocktail category was worth £624m to the on-trade last year, growing at 6.4% (CGA Mixed Drinks Report 2020 Q1)

- Mixed drinks – Getting the basic spirit and mixer right – particularly the popular gin and tonic – was key to growth. Some 40% of Great British spirits drinkers chose to drink gin out of home, up by 14% between 2018 and 2019 (CGA Brandtrack for February 2018 and 2019).

As already stated, consumers are attempting to replicate on-trade trends and experiences at home. It does mean there have been more spirits sales in the off-trade, however, it hasn’t come close to replacing on-trade sales and, on a more positive note, implies customers are still seeking premium and experiential serves.

An example of this is the rise in interest of brands and products that bridge the gap between the on-trade and off-trade. Companies such as Cocktail Porter, which provides boxes containing cocktail ingredients, have been bringing a taste of the on-trade to people’s homes during lockdown.

“Cocktail in a can is the fastest growing RTD segment this year (+35% Value Change MAT),” says Hannah Dawson, Head of Off Trade Category Development at Diageo . “This has accelerated during lockdown with Cocktail RTDs growth doubling in the L4W (+73%), according to Nielsen Scantrack Total Market Value Sales week ending 16.05.20.

“Mixed drinks remain very popular amongst consumers (spirits sales in the Off Trade are +9.9% YoY in the last 4 weeks 18.05.20, Nielsen) and, when safe to do so, we look forward to working with operators to safely serve delicious mixed drinks in their outlets.”

Learning from other markets:

China lifted its full lockdown rules recently, offering the UK on-trade to understand how its customers might react.

- In China, half of customers have returned to the on-trade, but visit frequency has been hit – 48% have visited the on-premise since restrictions have been lifted, but they are not visiting as often.

- They are demanding an exceptionally high standard of hygiene, with staff protective equipment, fewer people in outlet and pre-entry temperature checks important for over half of all people surveyed.

(CGA China recovery May 2020– COVID-19)

Of course, the trend in consumers making drinks at home over the past few months hasn’t passed operators by. Tom Proud, front of house and bars manager and Crafted Projects, a pubco in the north east of England, has already taken it into consideration when planning for reopening. While he believes many customers will be raring to get back to the bar for a professionally made drink, he does have minor reservations about what it could look like.

“I think classic cocktails will be on the rise – perhaps they've tried them at home and want to see how they taste made by a professional. Premium products, in my opinion, will continue to rise. They've [consumers] had the supermarket offerings for the past three months,” he says.

“Knowing that more and more people will have been making their own cocktails at home – judging by the rise in spirit sales – consumers have perhaps been experimenting with techniques and watching YouTube videos and learning how to make their favourite drinks.

“So, I might expect either of the following to happen: complex and premium offerings to rise, as some customers will appreciate the craft of cocktail making more, having tried it at home; or premium cocktails will suffer, due to the same reason. Perhaps people have been missing the simple pleasures, such as a cold pint in a beer garden with mates.”

When it comes to setting up the cocktail offering in his bars, a big focus is going to be on ensuring the cost of production remains low, while the experience offered is high. “I think we will initially offer a reduced menu, including fewer fresh garnishes, purées, juices, etc to gauge where we are and also to reduce wastage in this difficult time. Once we have established a demographic we will pitch our menu accordingly.”

Proud is perhaps right to consider various scenarios as there won’t be a one-size-fits-all for every outlet. With this in mind, it’s important to look at the long-term drinking trends the on-trade was working with prior to the coronavirus lockdown. As we’ve already established, some of these trends have carried over into consumer’s homes, cementing the fact that the experience of a well-made drink is important to them.

You don’t have to look far before discovering the consumer’s desire and commitment to high-quality drinking experiences. One example is the popularity of the Top 50 Cocktail Bars online Speakeasy, a digital bar where bartenders from the on-trade have taught hundreds of consumers how to make cocktails properly.

As a result of initiatives like online cocktail bars and consumers making drinks at home, many in the sector believe the public have a thirst to get back into a bar and enjoy themselves. However, it’s unlikely to happen organically, at least not in the long-term, and so operators will, as ever, need to think creatively about how to bring punters back into their venues.

Some key pieces of advice are to maximise special occasions, such as bank holidays and other celebratory dates. But also to create your own and market them to consumers, taking into account the Government’s guidance at the time. Consider creating packages for catching up with friends, personal celebrations, romantic occasions and treats.

Special occasions, for example, are the second biggest drinking occasion for consumers to drink spirits in the on-trade, according to Kantar Worldpanel Alcovision for the 12 months to 31 December 2019. Add to that the fact customers who pre-book for a special occasion tend to spend an average of 18% more in the on-trade per-month and there is the potential to harness steady sales.

Serve strategy from Diageo

Draught beer, mixed drinks and cocktails are synonymous with a great out-of-home occasion. Here’s what you need to know:

- There is an increased uptake of gin among spirit drinkers, ranking in the top categories drank out-of-home. Some data suggests that 40% of spirits drinkers choose to drink gin out-of-home, up by 14% between 2018 and 2019 (CGA Brandtrack Feb 2019 and Dec 2018)

With the right safety measures in place, there is likely to be great opportunities for spirits in the on-trade after reopening:

- Use digital menus or social media to showcase spirits ranges, and think about stocking something new that customers might want to try

- Make sure every serve is as perfect as possible, including plenty of ice and a pretty garnish

- Position mixed drinks as a little upgrade to a usual order and bring to life the occasion. Our MADE NOT POURED campaign seeks to deliver on this, bringing to life delicious mixed drinks made to suit any occasion

- Review your cocktail menu to focus on the serves requiring the least physical interaction, that are easier for your staff to make, and drive your margins

- Log in to MYDIAGEO.COM for tips on how Diageo can help

- Smirnoff Draught cocktails (passionfruit and espresso martini) are a great way to deliver some of the most popular serves in the UK in a fast, consistent and hygienic way

- (CGA Mixed Drinks Q1 2020 – Volumetric sales data – passionfruit #1, espresso #5)

- Register at MYDIAGEO.COM to find out more.

When thinking about which customer segments to target with specific offers and experiences, Covid-19 BrandTrack data for April 2020 showed that the groups more likely to visit the on-trade once lockdown lifts are 18–24-year-olds, with 28% saying so. This was followed by 25–34 at 27% and 35–44 at 22%.

“More widely, previously frequent visitors to the market are the most likely to return, but there is caution for medium frequency visitors,” says Sarah McCarthy, head of GB on-trade category development for Diageo. “Some 29% of consumers who would typically eat out multiple times a week state they will be comfortable doing so as soon as restrictions are lifted, compared to 20% for those eating out once or twice a month.

“Achieving a balance of stringent hygiene measures and fantastic service will be crucial for a successful reopening,” says McCarthy. “Working with our global Diageo Bar Academy team we have developed a suite of advice and training materials to assist outlets when considering their re-opening plans. Find out more MYDIAGEO.COM.”

In short, there’s no hard science to say what customers will want when pubs and bars will reopen. But if we reflect on and work with recent trends and projections, we can say it is likely they’ll want the same things they enjoyed before – premium, high-quality products and experience.

And it goes without saying, consumers will no doubt be craving such things having been deprived of them for so long. And so the same can be said about stocking and ranging; keep your spirits selection similar to what it was prior to lockdown, add in a surprise or two, but don’t take risks until you better understand what customers are doing in your venue.

Ultimately, adds McCarthy, “think carefully about where you reduce your range and seek category advice to manage your range down if necessary”.

Just like Proud from Crafted Projects in the north east, see what your customers want when they return and then present an offering that fits.